claim working from home allowance

What is the working from home tax relief allowance for 2021-22. You can claim if youve been asked to work from home since 6th April even if it was only for one day.

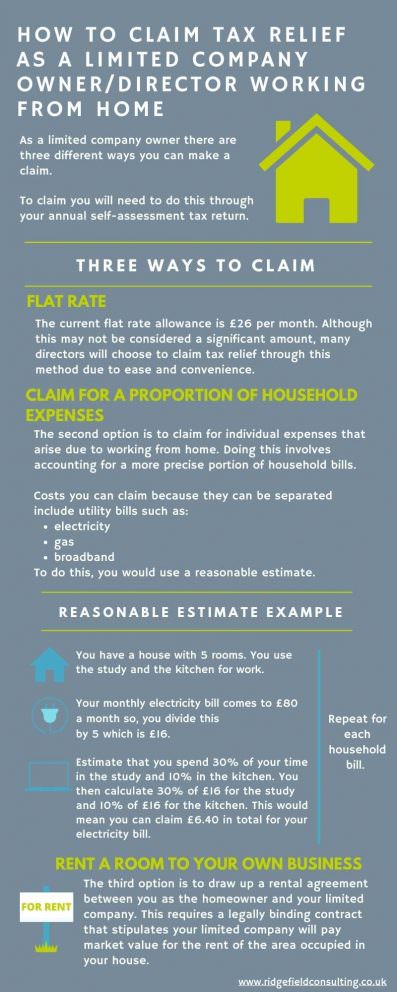

Different Ways To Claim Tax Relief When Working From Home

Scan the QR code on your mobile to download the Coconut app.

. What is the working from home tax relief allowance for 2021-22. Get Started for Free. The allowance is to cover tax-deductible additional costs.

Employees can claim allowance for working from home. Working from home You may be able to claim tax relief for additional household costs if you have to work at home on a regular basis either for all or part of the week. The way you claim the working from home allowance will depend upon if you submit a self-assessment tax return.

For more information please see the page How to calculate allowable remote working costs. The relief is to cover extra costs incurred such as. If you have been working from home during the pandemic you can apply for a tax rebate worth up to 125 per tax year.

To qualify you must. Must include this allowance as income in your tax return. HM Revenue and Customs HMRC has received.

Heres some good news if youre running a small business on the side of your day job. If not registered for self-assessment then an employee can use the form P87 procedure to claim this allowance. Once their application has been approved the online portal will adjust their tax code for the 2021.

In practice an employee who has been required to work at home at any point in the year can submit a full years claim to HMRC amounting to 312 6 x 52. They do not apply when you bring work home outside of normal working hours. Coconut helps you track income claim expenses and sort your taxes.

From 6 April 2020 employers have been able to pay employees up to 6 a week tax-free to cover additional costs if they have had to work from home. What main place of work means again varies. Can claim a deduction for the expenses you incur.

You can then also claim any additional days you worked at home in the year due to the COVID-19 pandemic. Twitter which now allows employees to work from home permanently if they opt to provides a 1000 remote work allowance. In fact stipends which have been described as The tech industrys new perk are offered by most big tech firms.

If you are claiming Remote. Not contractors and Google. Employees required to work from home can have a 6 per week or 26 per month allowance paid tax-free by employers or during the pandemic can claim a deduction from earnings for this allowance HMRC has confirmed.

To claim for tax relief for working from home employees can apply directly via GOVUK for free. If two or more of you live in the same property youre all required to work from home and its fair to say that costs have increased specifically from each individual working from home you can all claim it. How to claim 60 off the Government for working from home.

That includes even if people have only worked from home for some of the year to avoid needing to contact us if you have to work from home again The scheme allows people to claim a tax relief on 6 a week - according to the HMRC website. You can only claim for the days you worked from home as a remote worker. Start your free trial today.

Employees who have not received the. There are special rules for employees who work from home. Work From Home Allowance Calculator Coconut.

Hi Ive received communication today that my tax code has changed and when I checked it is because the allowance for working from home has stopped. Do you work from home regularly. Anyone whos been told to work from home by their employer to help stop the spread of COVID-19 can now claim tax relief.

If you are not reimbursed by your employer but receive an allowance from them to cover your expenses when you work from home you. Prior to April 2020 the maximum amount that could be claimed a. You may be entitled to tax reliefIn our latest animation we explain everything that you need to knowFor further help and.

Employees working from home are able to claim a weekly allowance of 6 per week 4 per week up to 5 th April 2020 to cover the additional costs extra heat light etc arising. Have a formal agreement with your employer that you are required to work from home Be required to perform essential duties of employment at home. I have been working from home since 5 March and cannot find how to claim the allowance on my tax return.

Enter your email below to download the app. Special rules for home-working employees To from tax relief for home at home as an employee it will normally be necessary for your contract of employment to require you to work from home. If you are working from home you may be entitled to claim the working from home allowance.

If you work from home you can claim a deduction for the additional running expenses you incur. As does Facebook to full-time employees. WFH allowance stopped.

Everyone else needs to make a claim to HMRC by post telephone or via the new P87 micro-service HMRC launched on 1 October 2020. Tap on the App Store link to download the Coconut app. The 2022 budget could also introduce tax-free work-from-home allowances for employees.

If they do your employees would not have to pay income tax or National Insurance contributions on the payments they receive. If you do then simply make a claim on your 202021 tax return. Through a self-assessment tax return.

So if youve had an increase in costs because youre required to work from home you can claim it. Home working tax-free paymentsallowances. Youll get tax relief based on the rate at which you pay tax.

As I complete a self assessment for property I own it states it must be done through this however cannot see anywhere or the form to add this. I thought I just needed to claim again however the system defaults to a message saying I dont need to claim as I will get any allowances automatically carried over. From April 2020 the weekly amount that tax relief can be claimed on without having to provide evidence of costs was increased to 6.

The allowance can be paid without the employer having to justify the expenses or the worker having to keep receipts to calculate the true cost. The arrangements in this section only apply to remote working. There are a few ways for employees to claim the home working allowance.

If you worked more than 50 of the time from home for a period of at least four consecutive weeks in the year due to the COVID-19 pandemic you can claim 2 for each day you worked from home during that period. These expenses fall under the general category of working away from home allowances - provided they meet HMRCs qualifying criteria. The working-from-home tax relief is an individual benefit.

There is no need to.

How Do You Claim Working From Home Tax Relief Bluespot Furniture Direct

Claiming Tax Back On Home Working Expenses Low Incomes Tax Reform Group

Claim 6pw For Working From Home Expenses Cardens Accountants

Working From Home Tax Deductions Covid 19

Martin Lewis Working From Home Due To Coronavirus Even For A Day Claim Two Years Worth Of Tax Relief

Different Ways To Claim Tax Relief When Working From Home

Working From Home Tax Relief How To Claim Tax Relief

Working From Home What Expenses Can You Claim Newby Castleman

0 Response to "claim working from home allowance"

Post a Comment